ontario ca sales tax 2021

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. The boundary may not line up exactly with the photo and it may not be a current representation of the structures if any as shown in the image.

Which Sales Tax Do I Charge When Selling Out Of Province

2020 rates included for use while preparing your income tax deduction.

. The tenders will then be opened in public on. Will affect the property after the tax sale. Taxtips Ca 2021 And 2022 Investment Income Tax Calculator Sales Tax Calculator How To Calculate Sales Tax In Excel Tutorial Youtube 91762 Sales Tax Rate Ca Sales Taxes By Zip.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. Sales Taxes in Ontario. The increase in the revenue forecast is due to.

Of the structures if any as shown in the image. Visit wwwcragcca or call 1-800-959-8287. Retail sales tax RST is charged on.

Prince Edward Island HST. Did South Dakota v. 91758 91761 and 91764.

The County sales tax rate is 0. For payments based on your 2021 income tax and benefit return July 2022 to June 2023 the program provides a maximum annual credit of 324 for each adult and each child in a family. Reverse Sales tax calculator OntarioHST 2021.

Ontario Retail Sales Tax TaxTipsca Ontario HST Ontario HST. Method to calculate Ontario sales tax in 2021. The HST was adopted in Ontario on July 1st 2010.

Paying the HST on a new car is straightforward when it comes to Ontario. This will be emailed to you usually on the first business day after you placed your order occasionally this might take an extra day. What Is Gst And Pst In Canada.

Select the California city from the list of cities starting with O below to see its current sales tax rate. Sales tax calculator British-Columbia BC GSTPST 2021. For example if a good is sold for 1000 you pay 1050 after GST is included.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. What is the sales tax rate in Ontario California. This is calculated as 1000 50 ie.

Thu Jul 01 2021. Those district tax rates range from 010 to 100. Quebec Consumption Taxes -.

Atlantic Canada including New Brunswick Newfoundland and Labrador Nova Scotia and Prince. The latest sales tax rates for cities starting with O in California CA state. An alternative sales tax rate of 9 applies in the tax region Montclair which appertains to zip code 91762.

Some areas may have more than one district tax in effect. The Ontario California sales tax rate of 775 applies to the following three zip codes. Ad Find Out Sales Tax Rates For Free.

Reverse Sales tax calculator British-Columbia BC. A 5 gross sales tax rate is applied in Alberta British Columbia Manitoba Northwest Territories Nunavut Quebec Saskatchewan and Yukon as of January 1 2014. Hours of Service Monday to Friday 830 am to 500 pm.

Rates include state county and city taxes. Fast Easy Tax Solutions. Did South Dakota v.

The County sales tax rate is. Sellers are required to report and pay the applicable district taxes for their taxable. The December 2020 total local sales tax rate was also 7750.

Ontario taxes and COVID-19. 15 rows 2021 Sales Tax Rates in Canadian Provinces and Territories. The aerial photos were taken in the Spring of 2021.

The minimum combined 2021 sales tax rate for ontario california is. The Ontario sales tax credit OSTC is a tax-free payment designed to provide relief to low- to moderate-income Ontario residents for the sales tax they pay. Local time on March 24 2021 at the Hilliard Township Office 951678 Highway 569 Hilliardton Ontario.

Thursday July 01 2021. This is the total of state county and city sales tax rates. The Ontario California sales tax rate of 775 applies to the following three zip codes.

That means that your net pay will be 37957 per year or 3163 per month. Neither the municipality nor Ontario Tax Sales Inc. If you are single your 2020 base year payment could be up to 456 from July 2021 to June 2022A woman must pay 598 on her marriage or in the case of a partnership.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The average sales tax rate in California is 8551. There is some items in Ontario that dont need sales taxes such as basic groceries some drugs child accessories in cars and more.

The minimum combined 2022 sales tax rate for Ontario California is. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Prince Edward Island HST.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Title Search Summary Toronto 2022-06-29-22. Ontarios government estimates that 13 HST of its GDP is generated by export.

The minimum combined 2022 sales tax rate for Ontario Oregon is 0. Photographs are for convenience only. An 8 provincial.

The Oregon sales tax rate is currently 0. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. SALE OF LAND BY PUBLIC TENDER.

THE CORPORATION OF THE TOWNSHIP OF HILLIARD. Visit the ontario HST exemptions website. Ontario Retail Sales Tax.

Revenues in 202122 are projected to be 29 billion higher than forecast in the 2021 Budget. This online book has multiple pages. The minimum combined 2022 sales tax rate for Ontario California is.

If you are paying the HST such as 13 in Ontario you add 13 on top of the retail selling price. There are approximately 82703 people living in the Ontario area. The current total local sales tax rate in Ontario CA is 7750.

This is the total of state county and city sales tax rates. Wayfair Inc affect California. As of the 202122 First Quarter Finances the government is projecting a deficit of 324 billion in 202122 an improvement of nearly 700 million from the outlook presented in the 2021 Budget.

The Ontario sales tax rate is. Take Notice that tenders are invited for the purchase of the land described below and will be received until 300 pm. Learn about retail sales tax on private purchases of specified vehicles and on certain premiums of insurance and benefits plans.

Remember that zip code boundaries dont always match up. Quebec Consumption Taxes - Businesses. The Ontario sales tax rate is 0.

The HST is made up of two components. The California sales tax rate is currently. For example if your purchase costs 1000 you.

Find out what mortgages liens executions etc. The statewide tax rate is 725.

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Pin By Andy Hong On Mortgage Easy Loans The Borrowers Cash Out

Pin By Nollewenn Roger On Deco Interieur Beverly Hills Houses Trousdale Warm Modern

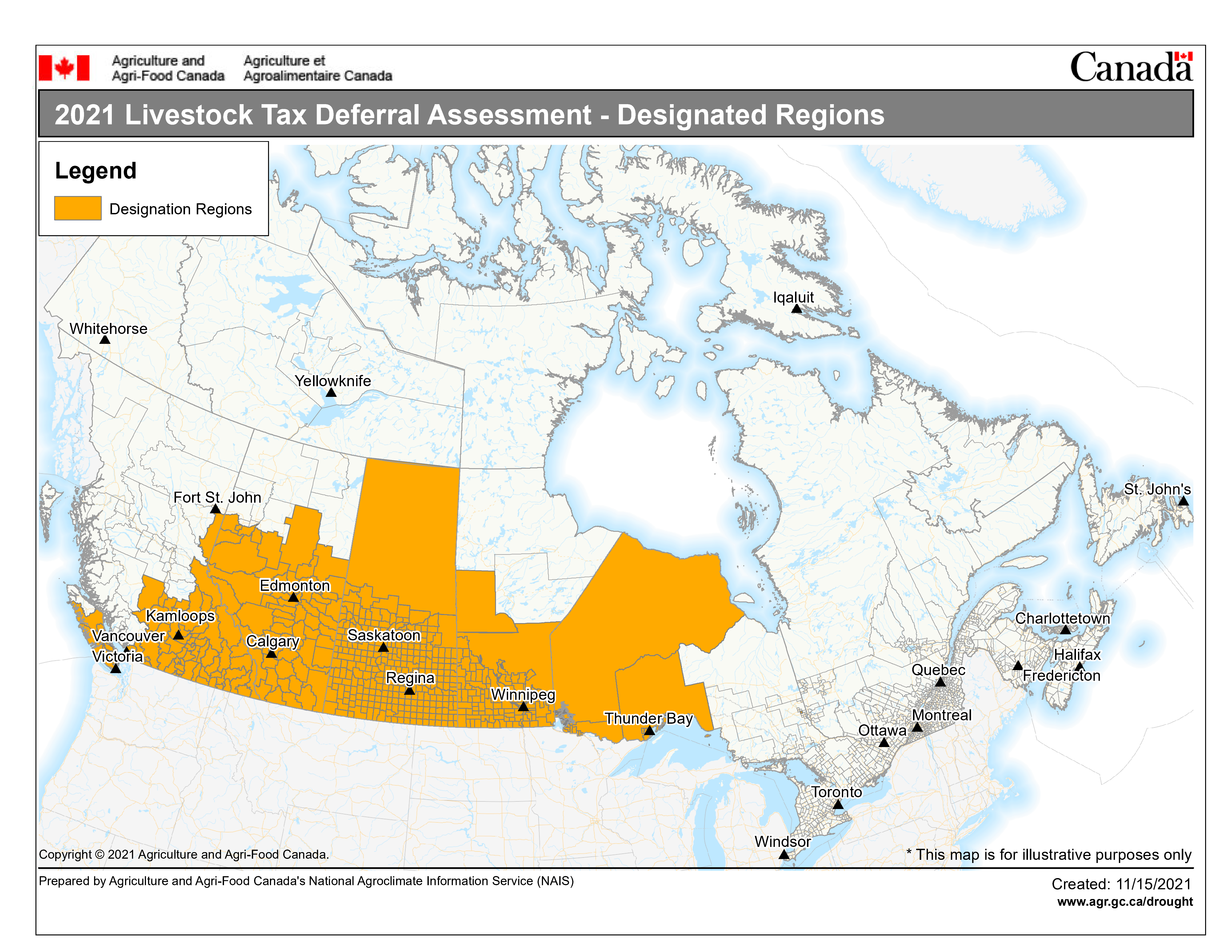

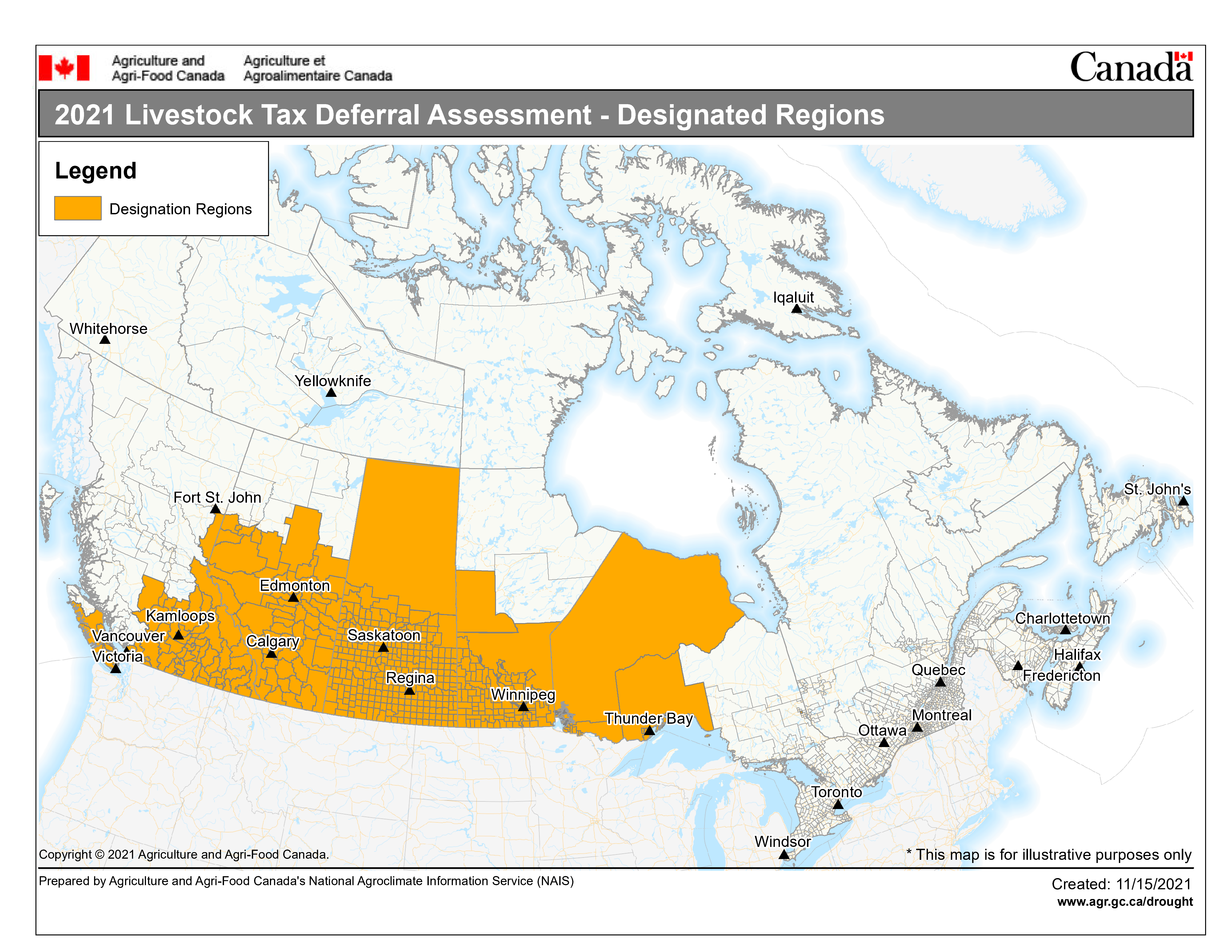

2021 Livestock Tax Deferral Prescribed Regions Agriculture Canada Ca

The Newly Rebuilt Contemporary Masterpiece In The Iconic Trousdale Estate Is A Luxurious Home With Highly Luxury Homes Contemporary Mediterranean Modern House

Ontario Income Tax Calculator Wowa Ca

1910 Loma Vista Dr Beverly Hills Ca 4 Beds 5 Baths Beverly Hills Houses Modern House Residences

Texas Dealer Temporary Tags Template Tag Template License Plate Template Printable

Tax On Rental Income Calculator Tips Wowa Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

City Of The Future Applying Fractions In Project Based Learning Project Based Learning How To Apply Fractions

Faqs Frequently Asked Questions Ufile

Stunning Infinity Pool Modern House Infinity Pool Architect

Two More Communities Coming To The Inland Empire Woodside Homes New Home Buyer New Homes For Sale

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Canada Sales Tax Gst Hst Calculator Wowa Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips